What is Quorum Blockchain?

Quorum Blockchain (“Quorum”) was developed by J.P. Morgan Chase back on and it serves as one of the first major steps by an enterprise to push for the common adoption of blockchain technology among financial industries.

This followed JPMorgan’s 2019 successful launch of JPM Coin, a digital coin representing the U.S. dollar designed to facilitate instantaneous payments between institutional clients.

What is Quorum Blockchain?

Think Office-365 for the Blockchain. Quorum is an enterprised-focused, permissioned blockchain infrastructure specifically designed for financial use cases.

You have questions already, so let’s jump in.

Understanding the Infrastructure

Depending upon its cryptographic characteristics, hash functions can be applied in two different ways: password storage and data integrity.

Quorum is built off “Go Ethereum”, the base code for the Ethereum blockchain. However, Quorum differs from Ethereum in four ways:

- Infrastructure

- Data Privacy

- Consensus Mechanism - Voting-based consensus mechanisms

- Performance - Higher performance

Let’s explore each.

#1 - The Infrastructure

When exploring blockchain technology, it’s always important to distinguish between “permissioned” and “permissionless” blockchains.

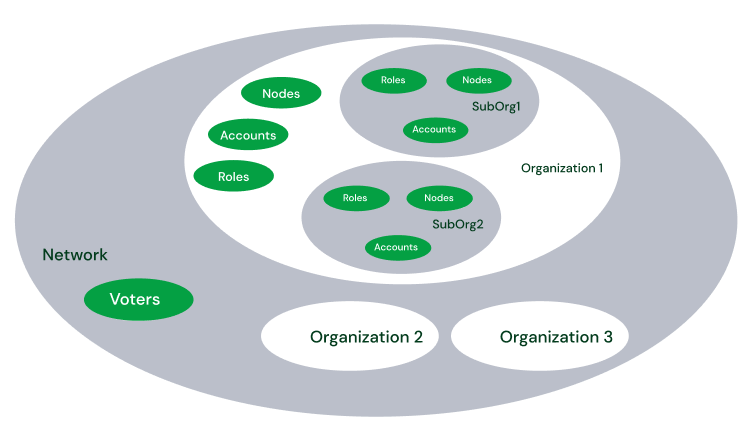

Quorum is best described in two ways. First, it is a “permissioned” blockchain, which provides for value transfer, smart contract deployment and execution.

Second, it’s a “consortium” blockchain. Ultimately, only certain participants, who are pre-approved by a designated authority, can be allowed onto the network. This is to avoid any potential threat of catastrophic failure or security breach.

Permissionless blockchains, on the other hand like Ethereum, make it available to all.

Consequently, the expectations of trust as between approved nodes than those without permission, are significantly different (even if the architecture between the two is the same).

#2 - Data Privacy Here Is Essential

We don’t have to remind you on how important data privacy (and security is). However, for blockchain technology, it’s embedded to its very core and purpose. Obviously, financial institutions have displayed great hesitation in adopting such technology due to the high-risk of failing to keep records confidential--something regular blockchains fail to address.

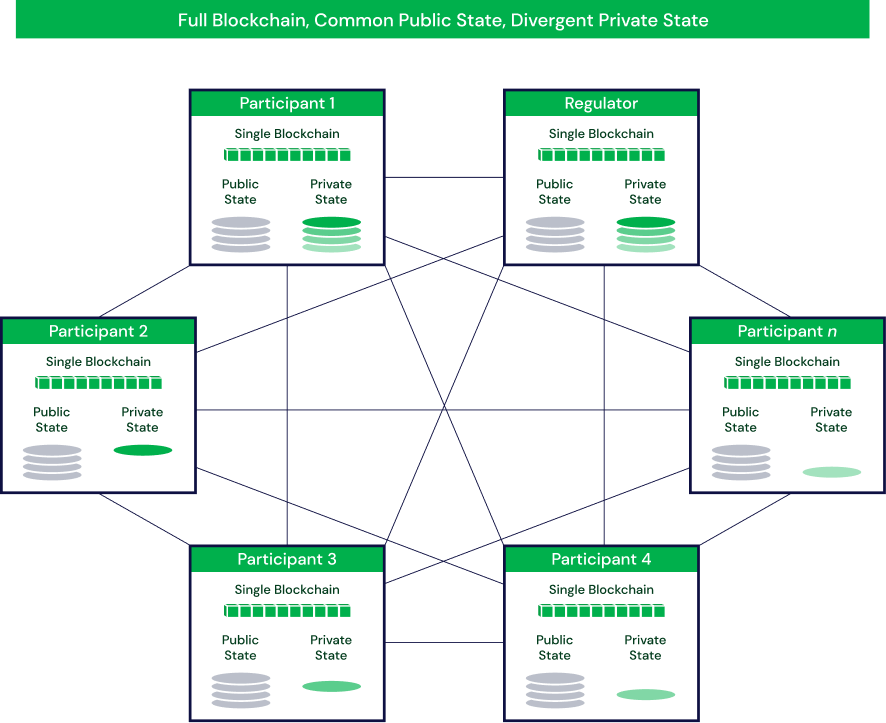

As a consortium blockchain, Quorum addresses data privacy head on by utilizing “cryptography” and “segmentation”, which prevents everyone but those specific parties to a transaction from seeing sensitive and/or confidential data.

One of Quorum’s most appealing and significant features is the Constellation system. It secures the messages by enslaving it. In this enclave, there are previous transactions, authenticity, and authentications. Thankfully, cryptography makes it a secure and safe mechanism.

Cryptography, a method that’s been used since World War II, is applied specifically to data in transactions, which is visible to everyone on the Blockchain. Segmentation, however, is applied to each Quorum node’s local state database, which contains the contract storage and is only accessible to the node.

Public vs. Private Transactions

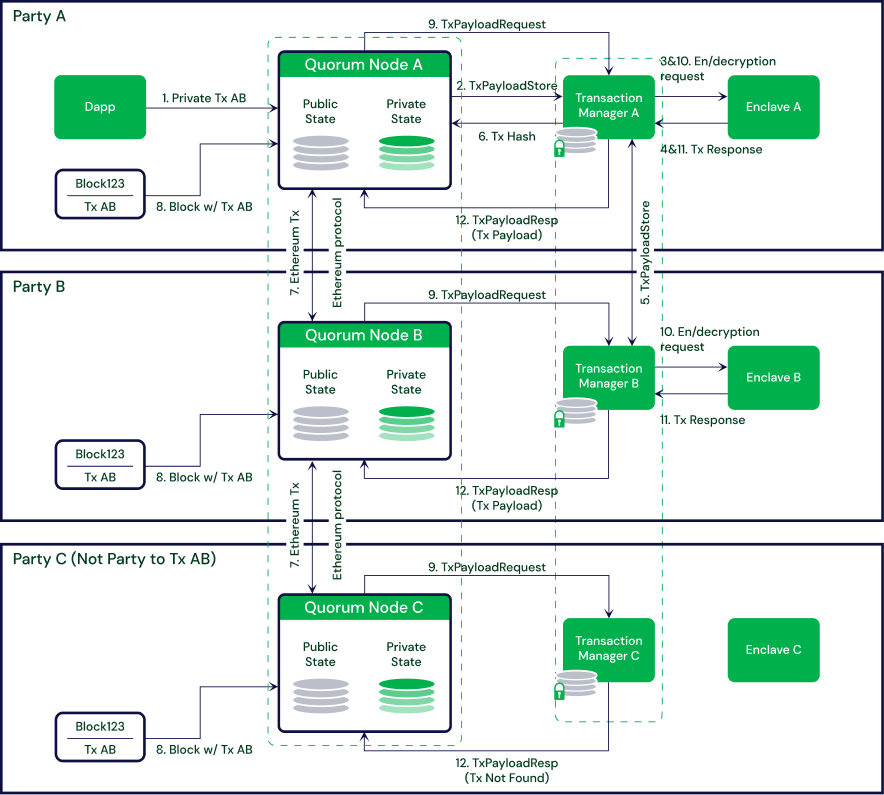

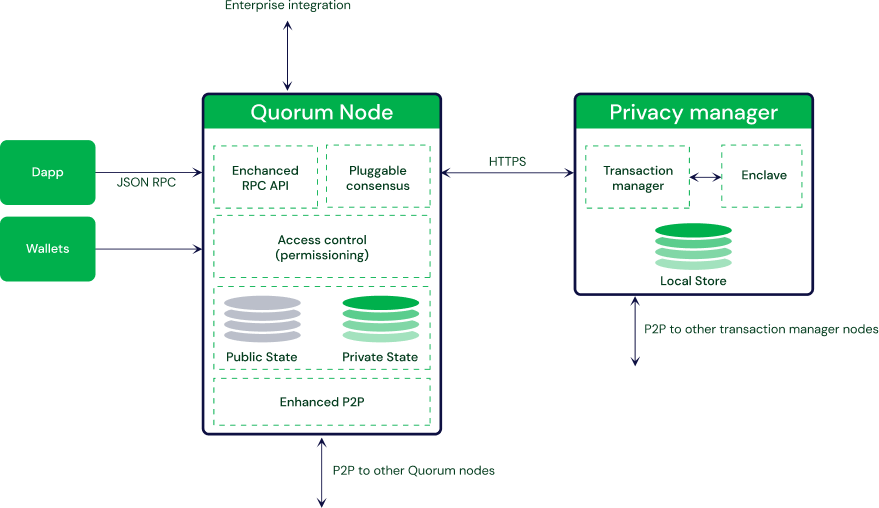

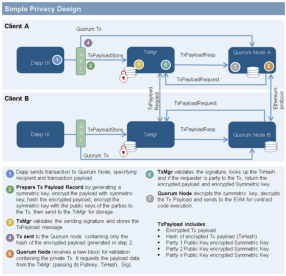

Quorum supports both public and private transactions, which are handled through both a “transaction manager” and “privacy manager”.

The “transaction manager” allows for the automatic discovery of other transaction manager nodes on the network, while exchanges encrypted payloads with other nodes’ transaction managers and storing that data.

The “privacy manager” allows Quorum nodes to share transaction payload securely by and between pre-approved participants to the transactions. The privacy manager includes the transaction and enclave.

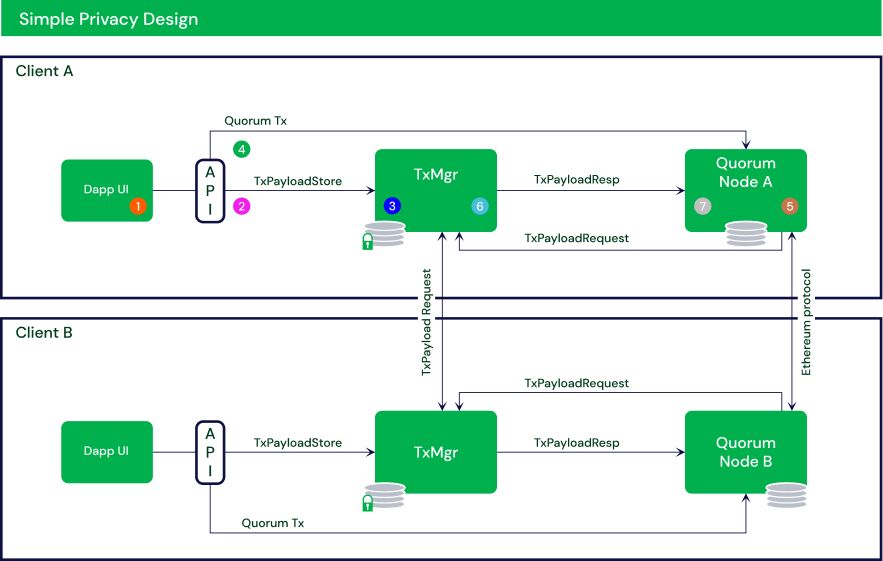

Like traditional Ethereum transactions, Quorum’s public transactions operate in a consistent manner, publicizing the transaction’s details. Private transactions, on the other hand, are verified, hiding the transaction’s details from the public off-chain. The graph below illustrates how Quorum processes private transactions:

In private transactions, Quorum communicates with the privacy manager using HTTPS, enabling only parties to the smart contract to see what’s contained in the smart contracts. This is a major element as to why banks are hesitant on exposing sensitive information contained in them, such as investment strategies, transaction data, and other sensitive internal information.

The graphic below depicts a simply privacy transaction:

- Encrypted Tx payload

- Hash of encrypted Tx payload (TxHash)

- Party 1 Public Key encrypted Symmetric Key

- Party 2 Public Key encrypted Symmetric Key

- Party n Public Key encrypted Symmetric Key

#3 - Consensus and Voting

It would make sense that an expensive PoW consensus mechanism would be applicable here, but consortium chains require something else. Due to high performance requirements, slower public chain consensus mechanisms don’t work for consortium chains like Quorum.

Thus, there are three specialized consensus mechanisms that are more suitable for private blockchains: RAFT-based consensus, Istanbul BFT Consensus, and Clique Consensus.

QuoromChain and Voting

Quorum uses a majority voting protocol called QuorumChain, which delegates voting rights to others. The block with the most votes will win and is considered the canonical head of the chain.

The QuorumChain can be found embedded within the smart contract, which assigns voting rights while simultaneously tracking the status of all the voting nodes.

#4 - Higher Performance

Lastly, Quorum performs significantly higher than a traditional PoW blockchain for enterprise networks.

According to one study, the transaction per second (TPS) speed is reported as high as approximately 2,500 TPS. Another study, the TPS of private contract deployments is measured as high as approximately 700 TPS, with normal transactions at approximately 2,000 TPS.

Either way, the TPS makes Quorum suitably designed for enterprise performance. And the key to any enterprise is of course, its security mechanism, RBAC (Role Based Access Control).

Why JP Morgan Divested Quorum to ConsenSys?

On August 25, JPMorgan Chase announced that it would be divesting from Quorum, but will still indirectly hold a piece of the business. It sold its platform to ConsenSys, a privately held fintech company, which has renamed the platform to ConsenSys Quorum.

As part of the divestment, JP Morgan Chase also invested strategically in ConsenSys, but that deal remains undisclosed as to the size of the investment, according to CoinDesk. As for JPM Coin, which remains 100% JPMorgan’s, it will continue to be built upon ConsenSys Quorum.

Daniel Heyman, ConsenSys engineering manager, has stated that anyone who builds on Quorum will get a proper software vendor behind their technology:

“They’ll get a roadmap that’s very explicit publicly maintained that they can build against and move towards, and a suite of features and functionality they can now purchase to accelerate their time to market”.

What It Can Do For Us?

Aside from JPMorgan’s creation and divestment, Quorum is used in logistics, healthcare, identity protection, property, payments, capital markets, and post trade. In other words, its pretty valuable, hence why JP Morgan upon selling it to ConsenSys, also invested in the newlyformed, ConsenSys Quorum.

For businesses that want to reduce the “human element” of aggregating, amending, and sharing data, Quorum will allow for less manual intervention in these processes, which will in turn provide for employees to spend more time on their actual responsibilities.

What’s the Industry Saying?

Despite being heavily used for financial services (and JPM Coin), Quorum has proved to be fairly versatile, according to CoinTelegraph. Indeed, it’s been introduced into industries where assets like privacy are more desirable than complete public transparency.

There’s a reason why State Farm, Starbucks, Microsoft’s Xbox, SAP, among others have begun their move towards adopting the Quorum blockchain framework.